Message from the President

Top Interview

-

Greeting

Dear shareholders, we hope this report finds you in the best of spirits.

Allow us to present the overview for the first half of 2025.

First-Half Performance

In the first half of 2025, driven by growth in inbound demand, we implemented enhanced sales and promotional activities tailored to seasonal trends and the characteristics of specific countries and regions, resulting in an increase in guest stays compared to the same period the previous year. Additionally, flexible pricing based on supply and demand trends led to an increase in the average revenue per guest, primarily within the accommodations segment. Within the banquet and wedding segments, efforts to strengthen product appeal through facility renovations and service enhancements proved successful, bringing an increase in the number of guests.

As a result, the Group's consolidated net sales increased by ¥4.0 billion year-on-year to ¥39.9 billion. Operating income increased by ¥1.7 billion year-on-year to ¥6.8 billion, and ordinary income increased by ¥1.1 billion year-on-year to ¥6.7 billion. Interim net income attributable to owners of the parent company increased by ¥0.5 billion year-on-year to ¥4.5 billion, primarily due to the recognition of tax expenses related to the elimination of accumulated losses carried forward.

First-Half Efforts

In the WHG Business, we conducted sales activities tailored to specific regions and distribution channels, including participation in trade shows in Europe, the Americas, Australia, and Southeast Asia. This resulted in capturing inbound demand and leading to an increase in ADR (Average Daily Rate). Our systematic renovation of guest rooms and other facilities to meet diversifying needs also contributed to this outcome. Additionally, we are actively promoting the appeal of WHG Hotels through initiatives such as expanding our signature breakfast menu based on the concept of “Breakfast that makes you want to wake up early,” hosting various special events, and planning and selling stays in whimsical concept rooms through corporate collaborations.

In the Luxury & Banquet Business, we increased the number of events and attendees in both the wedding and banquet divisions by renovating banquet halls to leverage their locations, developing new offerings, and reviewing and strengthening sales strategies. This drove overall revenue growth for the business. In the Accommodation segment, the introduction of high-value-added services at the newly established dedicated lounge in 2024 proved successful, driving an increase in ADR, particularly for suite rooms. Furthermore, focused efforts on proactive recruitment and talent development have enhanced service quality, supporting the overall growth of the business.

In the resort business, we commenced expansion work to increase guest rooms and expand restaurants at the Hakone Kowakien Hotel, and carried out a renovation of Hakone Kowakien Yunessun. At Hakone Kowakien Ten-yu, we established a system called “Celebration Stays” for commemorative stays. Starting before arrival, the proprietor contacts guests to understand their needs, enabling staff across all sections to collaborate and support their stay on the day of their visit. As a result of implementing these measures to enhance competitiveness in the Hakone area, where many luxury hotels have opened, we have received high praise from domestic and international travel agencies and online travel booking sites. To maximize the effect of the Hakone Kowakien redevelopment, we will continue to evolve our facilities, offerings, and hospitality, striving to enhance the value we provide.

Additionally, with the aim of securing a stable workforce, the Area-Based Position Course (a work system not requiring relocation) newly established in 2023 enhanced our competitiveness in the recruitment market. This enabled us to welcome over 160 new employees in 2025, continuing the trend from the previous year. With recruitment progressing smoothly, we are now shifting our focus to development. By enhancing training and education programs, we are promoting the improvement of management skills and specialized expertise, as well as supporting internal career development. We continue to enhance our workplace environment through measures such as improving compensation, increasing annual holidays by one day across the entire group, and introducing a system allowing employees to take paid leave in half-day increments. Through these initiatives, we aim to boost employee engagement and establish a positive cycle that attracts the talent we seek.

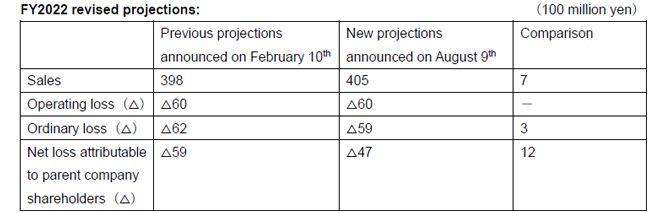

Revision of Earnings Forecast

Based on the strong performance in the first half, we have revised our full-year earnings forecast. For the second half, we have maintained our previous forecast, taking into account demand trends and customer traffic affected by factors such as the intense heat. The Group's full-year earnings forecast projects net sales of ¥80.5 billion, an increase of ¥1.9 billion from the previous forecast, operating income of ¥13.3 billion, an increase of ¥1.3 billion, ordinary income of ¥13.0 billion, also an increase of ¥1.3 billion, and net income attributable to owners of the parent company of ¥8.8 billion, an increase of ¥0.8 billion.

As announced on August 8, 2025, the remaining 20 shares of Class A Preferred Stock issued on September 28, 2021, were redeemed (acquired and canceled) on August 25, 2025. This completes the redemption of all 150 shares of this preferred stock issued. Going forward, we will continue to pursue growth and expansion initiatives. This includes strengthening our capital base and making investments aimed at medium- to long-term revenue growth, such as large-scale renovations in our WHG and resort businesses, to respond flexibly to market trends and changing needs. We sincerely request your continued support.

Shinsuke Yamashita

Representative Director and President,

Executive Officer

Fujita Kanko Inc.

- Policies

- IR Library

- Stocks